In small towns and emerging cities across India, the most powerful digital storefront isn’t an app built for commerce—it’s a green icon built for conversation.

From product discovery and peer validation to payments and post-purchase support, WhatsApp has quietly become the primary digital platform for nearly 90% of Bharat consumers, according to a new study by early-stage venture capital firm Rukam Capital. The finding sits at the heart of its latest consumer research report, Beyond Metros: The Real Story of Bharat’s Next 500 Million, which decodes how non-metro India is reshaping the country’s consumption economy.

The data makes one thing clear: India’s next phase of growth is not being driven by glossy metro campaigns or celebrity endorsements. It is being built, message by message, inside WhatsApp groups, community conversations, and local networks—far away from traditional advertising playbooks.

The Rise of Bharat’s Digital Backbone

WhatsApp’s near-universal penetration in Tier 2 and Tier 3 markets has transformed it into far more than a messaging app. It functions simultaneously as a communication layer, a discovery engine, a trust validator, and increasingly, a commerce enabler.

For Bharat consumers—65% of India’s population resides outside metros—WhatsApp offers what no other platform does: familiarity, low friction, and social credibility. Product links circulate in family groups, price checks happen in neighbourhood chats, and brand credibility is often tested through forwarded reviews and peer opinions long before a purchase is made.

This centrality reflects a broader shift in India’s economic centre of gravity. As consumption-led growth moves beyond metros, digital behaviour in Bharat is evolving with its own logic—one shaped by community influence, value discipline, and research-driven decision-making rather than impulse or aspiration.

Creators Trump Celebrities in a Trust-Led Market

One of the most striking findings of the report is the collapse of celebrity influence in non-metro India. While celebrities once defined aspiration, today they barely move the needle—only about 3% of consumers trust celebrity endorsements.

In contrast, creators have emerged as the new trust anchors, with 22–23% of consumers relying on creator recommendations. These creators are not distant stars but relatable voices who demonstrate products, explain value, and mirror everyday realities.

This change aligns with how discovery itself has shifted. Bharat’s consumers are no longer passively absorbing ads. They are actively researching.

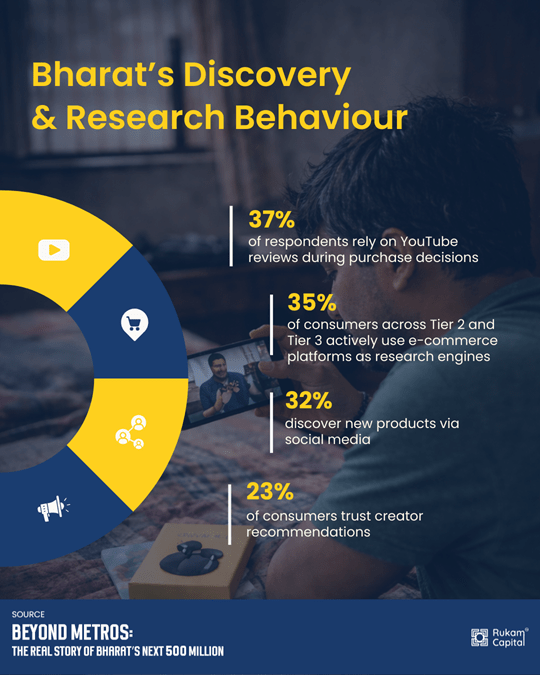

37% rely on YouTube reviews

32% discover products via social media

35% use e-commerce platforms as research tools, not just purchase destinations

In Tier 3 markets especially, YouTube has moved from validation to initiation—often becoming the very first step in the buying journey.

Trust, Not Speed, Drives Commerce

If metros are defined by speed and convenience, Bharat is defined by intent and discipline.

The report shows that non-metro consumers are cautious, deliberate, and deeply trust-led. Word-of-mouth influences 22% of purchase decisions, while 43% of Tier 3 consumers verify brands via official websites before buying. Customer service matters too, shaping decisions for nearly one-third of consumers even before money is spent.

This behaviour extends to payments. UPI has become the default transaction layer for 67% of Tier 2 and Tier 3 consumers, embedding digital payments into everyday life. But unlike impulse-heavy urban spending, this adoption reflects careful budgeting and value optimisation rather than instant gratification.

Festivals continue to drive discretionary spending, especially in Tier 3 towns, while discount-tracking is more prevalent in Tier 2 cities. Quick commerce and app-based convenience services remain uneven, underlining that Bharat’s digital adoption is pragmatic, not trend-chasing.

Platforms Win on Utility, Not Noise

Beyond WhatsApp, the report highlights a broader preference for utility-first platforms. OTT consumption is shaped by mass relevance and language, with JioHotstar leading usage across non-metro markets. Vernacular OTT platforms command loyalty among Tier 3 audiences, reinforcing the importance of localised storytelling.

Music apps and Telegram see strong adoption, particularly where they serve practical or community-driven use cases. Professional networking remains limited in smaller towns, though Tier 2 cities are beginning to show momentum, signalling a slow but steady rise in white-collar aspirations beyond metros.

Aspiration Rewritten: Subtle, Personal, Grounded

Perhaps the most important takeaway from the report is how aspiration itself is changing. Bharat consumers are not rejecting ambition—they are redefining it.

Only a small segment responds to overt luxury or pop culture cues. Instead, aspiration is expressed through bespoke offerings (18%), quality-led status (13%), and even nostalgia and smart technology when it delivers visible everyday utility. Sustainability claims resonate too, but only when backed by authenticity and peer reassurance.

Gaming, meanwhile, has emerged as an unexpected high-intent channel, with over half of Tier 2 and Tier 3 consumers responding positively to in-game advertising—suggesting new, underexplored avenues for brand engagement.

A Market That Is No Longer Emerging

Commenting on the report, Archana Jahagirdar, Founder and Managing Partner at Rukam Capital, notes that Bharat has long been misunderstood through a metro lens.

“What we saw through this study is a far more confident and deliberate consumer—one who researches deeply, relies on community validation, and values consistency over hype,” she said. “The opportunity in Bharat lies in building trust early and staying rooted in real use cases.”

As India marches toward a trillion-dollar retail economy, the message is unambiguous: Bharat’s next 500 million consumers are not waiting to be discovered—they are already shaping demand, platforms, and narratives.

And at the centre of it all, quietly powering this transformation, is WhatsApp—where India’s next growth story is being typed, shared, and trusted, one message at a time.

Leave a comment